Introduction

A common question we receive from clients who have rental properties (commercial or residential) is what is deductible as repairs and maintenance, and what are capital improvements?

This is an area of constant discussion between clients and us and recent reviews by IRD into various clients' tax returns have thrown the spotlight back on these costs.

Background and Current Legislation

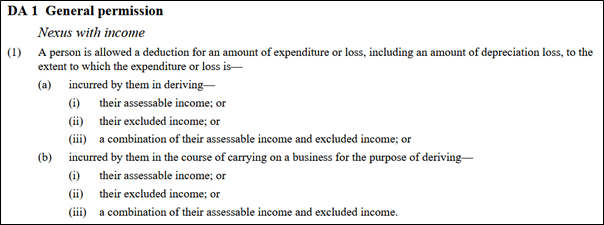

The basis for determining deductible expenses is governed by the Income Tax Act. Specifically, Section DA1, known as the 'General Permission.'

The law allows a person to deduct expenses against their income if they were incurred in earning that income and are not of a capital nature. Note that this only applies to self-employed income – salary and wage earners cannot deduct costs (with a few exceptions).

This legislation provides the framework for determining what taxpayers can and cannot claim. Sometimes, it can be a grey are to decide what is deductible and what is capital.

Example

Liam owns a rental property. The property was built in the 1970sThe wooden joinery around the south-facing windows has some rot starting. Liam decides to replace all windows in the house with aluminium joinery. The windows are replaced with double-glazed glass. The job costs $60,000. Can Liam claim this as repairs and maintenance?

Analysis

1. What is the asset?

The asset is the house – not the window frames or the glass

The window frames and glass are a component part of the assetThe asset (house) has not been replaced

Has the house been substantially improved?

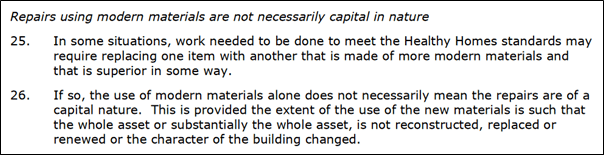

2. IRD provides some guidance from QB 20/01 below:

3. In this case, Liam could take the position that the cost of double glazing is deductible,

as it is now the industry standard - replacing like with like based on the modern equivalent.

This position has also be taken on other remediation work such as re-roofing, light

replacement, etc.

Conclusion

Determining what costs constitute repairs or capital requires professional judgment and consideration. IRD's default position for many significant expenses related to building is to class them as capital.

However, it is important to understand that IRD does not interpret the law; it only enforces it.

If our clients incur a significant expense related to a building, we will often query further details to ensure we understand all facts of the situation, and then, use professional judgment to establish a tax position in conjunction with them.

Contact Us

Contact Tim Doyle or Jane Evans today to discuss on 07 823 4980 or email us. Our office is in Cambridge, NZ, but distance is no problem. We have many international and national clients.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.